This month’s newsletter focuses on SDG 1: No Poverty. To highlight our work, we are featuring excerpts from our international and municipal policy work in Ethiopia and Long Beach, California, respectively. Specifically, these snippets convey how we tailor our recommendations to the needs and circumstances of each location, as well as how technology can be used to close the wealth gap through fostering cashless societies.

Excerpt from “A National AI Policy: Ethiopia”:

Mobile Payments and the Cashless Society

Current Situation: Ethiopia is almost solely a cash-based society. Even when accessing cash, a physical cashier is the main withdrawal method (83%) compared to ATMs (1%) (13).

Recommendation: By making all government benefits and distributions a cashless disbursement (via mobile payments, pay-wave enabled cards, and identity-linked cards), and providing every Kebele[1] with centrally shared devices for completing transactions (in traditional marketplaces and inter-family transfers) where digital devices are not otherwise available, Ethiopia can become a near-cashless society

, virtually eliminating fraud in financial systems, government services, and unlocking a wealth of information on the needs of the most vulnerable groups.

Artificial Intelligence can be leveraged to closely monitor the flow of funds to ensure integrity and efficiency, to understand the effect of government programmes/benefits, and to better understand the Ethiopian economy at the most detailed level.

Policy Objective:

Make it feasible for all transactions to take place digitally without significant additional frictions to those that exist with cash.

Excerpt from the “Intelligent Cities Report: Long Beach”:

Diversified and Expanded Banking Opportunities for Communities of Color

As cashless businesses become more prevalent, new solutions are necessary to bridge the financial divide. We recommend that the City of Long Beach create its own cashless options for citizens who do not want to use banks and incentivize banking in the next generation.

businesses become more prevalent, new solutions are necessary to bridge the financial divide. We recommend that the City of Long Beach create its own cashless options for citizens who do not want to use banks and incentivize banking in the next generation.

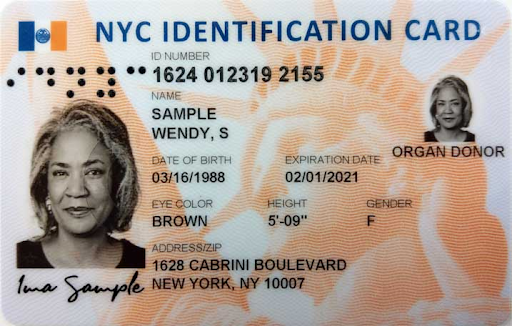

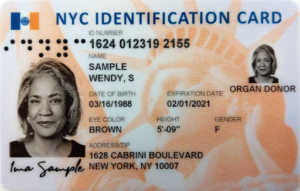

One such transitional cashless option is the ID NYC program. New York City has created a program in which every resident, regardless of immigration status or income including homelessness, can register for identification that is approved for police interactions, functions as a library card, and provides benefits such as discounted prescriptions and museums in the City.[2] Most importantly, it functions as necessary identification to open a bank account at select banks.[3] While the IDNYC program is not perfect, specifically in that the largest banks such as Bank of America do not yet accept the card as primary identification, it is a progressive step towards equitable banking access with 670,000 users as of 2015.[4]

One such transitional cashless option is the ID NYC program. New York City has created a program in which every resident, regardless of immigration status or income including homelessness, can register for identification that is approved for police interactions, functions as a library card, and provides benefits such as discounted prescriptions and museums in the City.[2] Most importantly, it functions as necessary identification to open a bank account at select banks.[3] While the IDNYC program is not perfect, specifically in that the largest banks such as Bank of America do not yet accept the card as primary identification, it is a progressive step towards equitable banking access with 670,000 users as of 2015.[4]

We recommend that the City of Long Beach implement a similar program to IDNYC, and partner with banks already noted in the Los Angeles County Bank On Initiative, a national movement to serve unbanked and underbanked communities by providing alternative identification options.[5] The City of Long Beach may want to expand upon this list with credit unions or banks closer to the in-need populations within the city.

For the next generation of citizens, AI for Good recommends the creation of incentivized savings accounts. Such an example is the Office of Financial Empowerment’s Kindergarten to College (K2C) program in San Francisco, which provides a $50 seed deposit to all kindergarten students and a $50 bonus to students enrolled in the National School Lunch program. Additional areas of the program are philanthropic dollar-for-dollar matching, as well as bonuses for families that save consistently. By 2015, this program had benefited 21,000 students with accounts totaling $3.4 million.[6] Such a program in Long Beach could garner trust amongst the community in banking and savings, while also providing a path for low-income students to go to college. A similar program was launched in 2021, entitled Opportunity L.A.[7]

Operational Considerations

Long Beach can use GIS, as well as census and income data, to identify the neighborhoods that are the most severely underbanked, and set up information booths around the city. In alignment with the City’s stance on AI Ethics and Data Privacy, any identification program would also have to have strict and transparent privacy guidelines. Additionally, the IDNYC program has had challenges due to the lack of large banks accepting the identification to open accounts.[8] The City of Long Beach has the opportunity to implement a similar program and address these challenges before rollout. To optimize a seed college savings program, Long Beach could consider a phased rollout, such as that deployed in Opportunity L.A., where the first round of students was chosen by the district’s Student Equity Needs Index that measures and tracks the percentage of students who may need additional support.[9]

Long Beach can use GIS, as well as census and income data, to identify the neighborhoods that are the most severely underbanked, and set up information booths around the city. In alignment with the City’s stance on AI Ethics and Data Privacy, any identification program would also have to have strict and transparent privacy guidelines. Additionally, the IDNYC program has had challenges due to the lack of large banks accepting the identification to open accounts.[8] The City of Long Beach has the opportunity to implement a similar program and address these challenges before rollout. To optimize a seed college savings program, Long Beach could consider a phased rollout, such as that deployed in Opportunity L.A., where the first round of students was chosen by the district’s Student Equity Needs Index that measures and tracks the percentage of students who may need additional support.[9]

1. Larger Kebeles should be provided with more devices to ensure nobody is locked out from the system.

2. Photo: “How to Apply – IDNYC.” 2022. Nyc.gov. https://www1.nyc.gov/site/idnyc/card/how-to-apply.page.

3. “About – IDNYC.” 2015. Nyc.gov. https://www1.nyc.gov/site/idnyc/about/about.page.

4. The New York Times. 2022. “Banks Reject New York City IDs, Leaving ‘Unbanked’ on Sidelines (Published 2015).” https://www.nytimes.com/2015/12/24/business/dealbook/banks-reject-new-york-city-ids-leaving-unbanked-on-sidelines.html.

5. “What Is Bank on – Consumer & Business.” 2022. Los Angeles County Department of Consumer & Business Affairs. Consumer & Business. https://dcba.lacounty.gov/bankon/.

6. “All-in Cities Policy Toolkit | Allincities.org.” 2022. Allincities.org. https://allincities.org/toolkit.

7. “Opportunity L.A. – LAHD.” Lacity.org. https://housing.lacity.org/community-resources/opportunity-la.

8. The New York Times. 2022. “Banks Reject New York City IDs, Leaving ‘Unbanked’ on Sidelines (Published 2015).” https://www.nytimes.com/2015/12/24/business/dealbook/banks-reject-new-york-city-ids-leaving-unbanked-on-sidelines.html.

9. Betty Márquez Rosales. 2021. “L.A. Unified to Launch Nation’s Largest District College Savings Account Program.” EdSource. EdSource. May 20. https://edsource.org/2021/l-a-unified-to-launch-nations-largest-college-savings-account-program/655207.